Blog

Read the latest news and views on the hot topics affecting the construction industry, along with construction accounting software insights from our expert team.

Neilcott on track to become debt-free employee-owned business – five years ahead of schedule

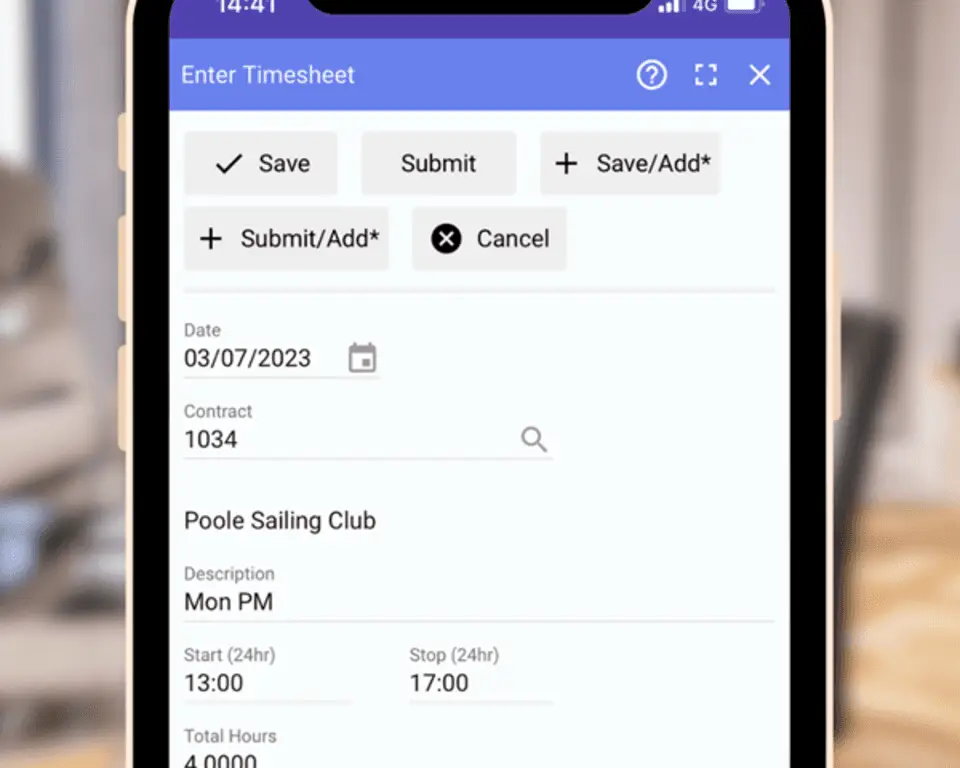

The Ultimate Guide to Accounting Software for Construction: Boost Efficiency and Profitability

Unlock Efficiency and Growth with Evolution Mx: Leading Software for Construction Companies

Understanding the Value of Evolution Mx: A Comprehensive Construction Management Software

Streamline Your Business with Evolution Mx: A Construction Accounting Program Tailored for the UK and Ireland

Consolidating your Accounting: The difference between “all-in-one” and comprehensive accounting solutions