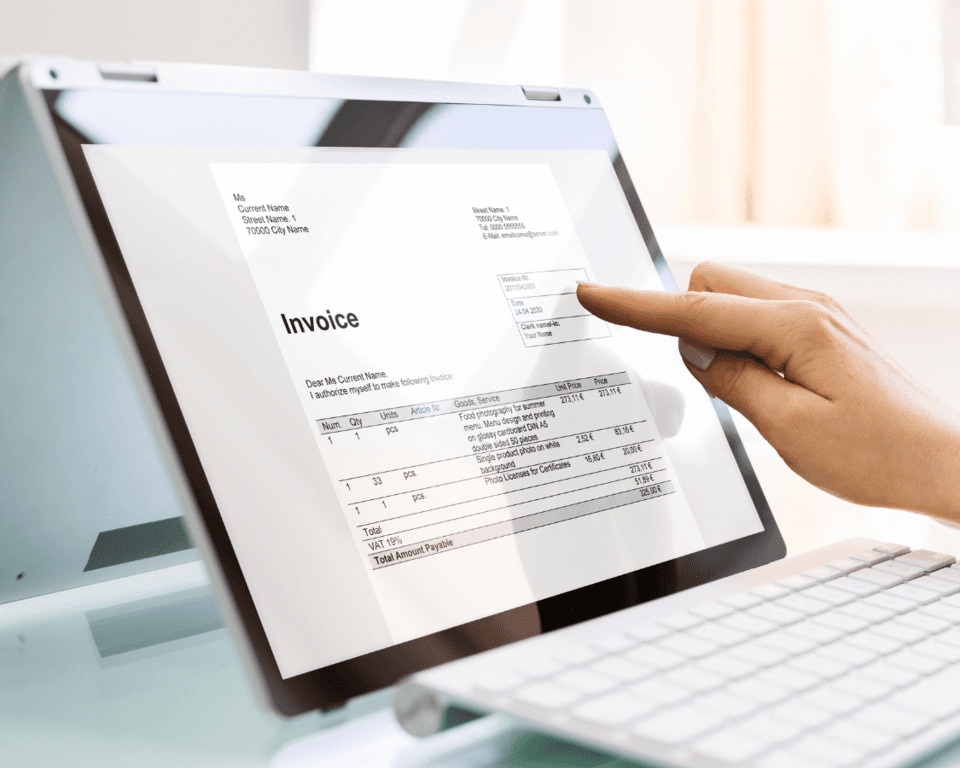

In fast-paced construction accounting, time is the key to productivity. Accountants in the industry are tasked with managing complex financial transactions, ensuring compliance with regulations, and providing accurate reporting—all while keeping projects on track and within budget. To help navigate these challenges, here are ten ways accountants can harness the power of construction accounting software to save time and improve productivity:

In the dynamic world of construction, good financial management is paramount. Construction accountants play a critical role in ensuring the financial health and success of their organisations. To optimize their performance, they must adapt to the unique challenges and opportunities they face. This article explores tips that construction company accountants can employ to enhance performance and contribute to success.